Featured

Table of Contents

- – How long does Level Term Life Insurance For Yo...

- – 20-year Level Term Life Insurance

- – Why should I have Level Term Life Insurance F...

- – Is there a budget-friendly Affordable Level T...

- – How does Level Death Benefit Term Life Insur...

- – Who has the best customer service for Best L...

- – What are the top Tax Benefits Of Level Term ...

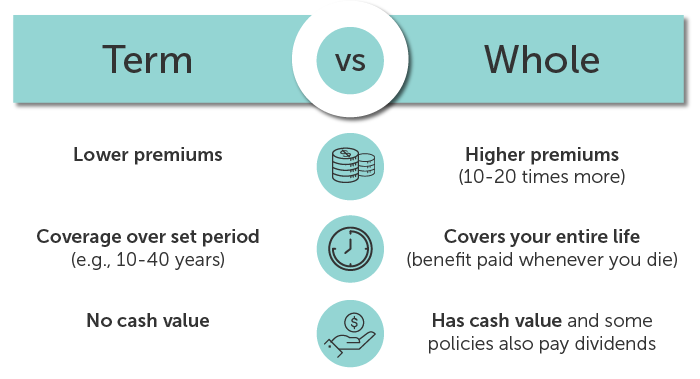

The major distinctions in between a term life insurance policy policy and a long-term insurance coverage (such as whole life or global life insurance policy) are the duration of the plan, the build-up of a money value, and the expense. The ideal choice for you will certainly rely on your requirements. Below are some points to consider.

People who have whole life insurance pay much more in premiums for much less protection yet have the safety of recognizing they are shielded for life. Level term life insurance policy. People that acquire term life pay premiums for a prolonged duration, however they get nothing in return unless they have the bad luck to pass away prior to the term expires

Additionally, substantial management charges often reduced into the price of return. This is the source of the expression, "get term and invest the distinction." The performance of permanent insurance coverage can be stable and it is tax-advantaged, providing extra benefits when the supply market is unstable. There is no one-size-fits-all answer to the term versus long-term insurance coverage debate.

The biker guarantees the right to convert an in-force term policyor one regarding to expireto a long-term plan without undergoing underwriting or confirming insurability. The conversion rider ought to enable you to convert to any irreversible policy the insurance firm supplies without any limitations. The primary features of the motorcyclist are keeping the initial health and wellness score of the term policy upon conversion (also if you later have wellness issues or come to be uninsurable) and choosing when and just how much of the insurance coverage to transform.

How long does Level Term Life Insurance For Young Adults coverage last?

Of program, overall costs will boost significantly since whole life insurance policy is more pricey than term life insurance policy - Guaranteed level term life insurance. Clinical problems that develop during the term life duration can not create costs to be raised.

Term life insurance is a relatively economical method to give a lump amount to your dependents if something occurs to you. If you are young and healthy, and you support a family members, it can be a great alternative. Entire life insurance policy features considerably higher month-to-month premiums. It is implied to give insurance coverage for as lengthy as you live.

It depends on their age. Insurance companies set an optimum age restriction for term life insurance policy plans. This is typically 80 to 90 years old, yet might be higher or lower relying on the company. The costs additionally increases with age, so a person aged 60 or 70 will certainly pay considerably greater than a person years younger.

Term life is somewhat similar to car insurance policy. It's statistically unlikely that you'll require it, and the premiums are cash down the tubes if you do not. If the worst takes place, your family members will receive the benefits.

20-year Level Term Life Insurance

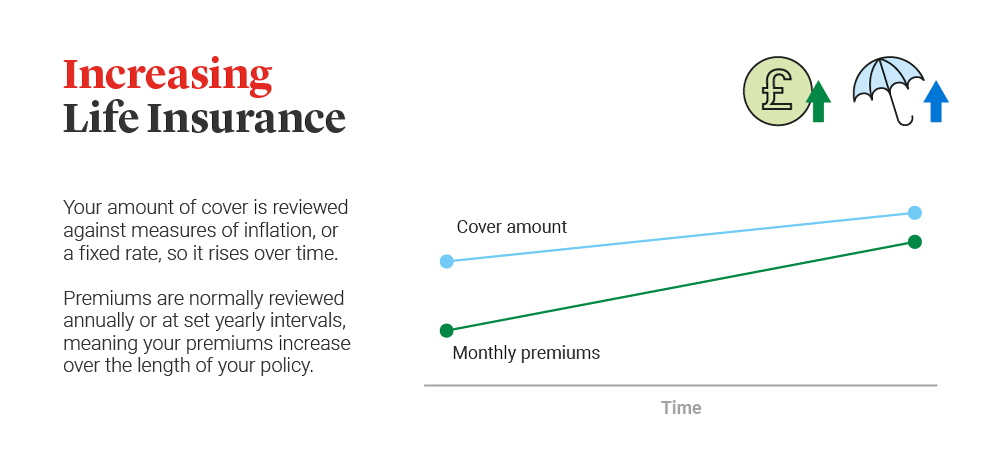

A level costs term life insurance strategy lets you adhere to your spending plan while you aid shield your family members. Unlike some tipped rate plans that raises annually with your age, this kind of term strategy provides rates that stay the exact same for the period you choose, even as you age or your wellness adjustments.

Find out more about the Life insurance policy alternatives readily available to you as an AICPA participant. ___ Aon Insurance Providers is the brand name for the brokerage and program administration procedures of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Solutions, Inc.

Why should I have Level Term Life Insurance For Families?

The Plan Agent of the AICPA Insurance Coverage Trust Fund, Aon Insurance Policy Services, is not associated with Prudential. Team Insurance protection is released by The Prudential Insurer of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Essentially, there are two kinds of life insurance policy intends - either term or permanent plans or some combination of the two. Life insurance firms use various types of term strategies and conventional life policies as well as "rate of interest sensitive" items which have actually come to be a lot more common since the 1980's.

Term insurance coverage gives protection for a given period of time - Tax benefits of level term life insurance. This period might be as brief as one year or give insurance coverage for a details variety of years such as 5, 10, 20 years or to a specified age such as 80 or sometimes approximately the earliest age in the life insurance policy mortality

Is there a budget-friendly Affordable Level Term Life Insurance option?

Currently term insurance coverage rates are very competitive and among the cheapest historically experienced. It needs to be noted that it is a commonly held idea that term insurance policy is the least expensive pure life insurance policy protection available. One requires to assess the policy terms very carefully to decide which term life choices are suitable to meet your certain conditions.

With each brand-new term the premium is raised. The right to renew the policy without evidence of insurability is a vital benefit to you. Otherwise, the risk you take is that your health might weaken and you may be unable to obtain a policy at the very same rates and even at all, leaving you and your recipients without protection.

The length of the conversion duration will certainly differ depending on the kind of term plan bought. The costs rate you pay on conversion is typically based on your "present acquired age", which is your age on the conversion date.

How does Level Death Benefit Term Life Insurance work?

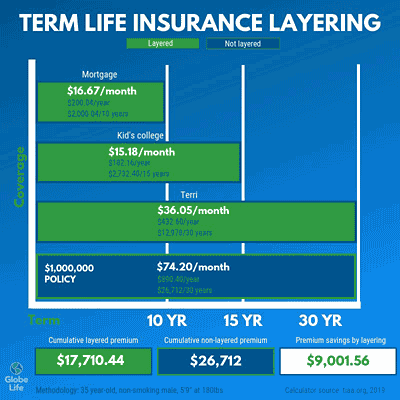

Under a level term plan the face quantity of the plan continues to be the very same for the whole period. Usually such policies are offered as home loan protection with the quantity of insurance policy lowering as the balance of the mortgage reduces.

Commonly, insurers have actually not had the right to change costs after the plan is offered. Considering that such plans may continue for lots of years, insurance firms should utilize conventional mortality, interest and cost rate estimates in the costs calculation. Flexible costs insurance coverage, however, enables insurance firms to use insurance coverage at reduced "present" costs based upon less traditional presumptions with the right to change these costs in the future.

While term insurance policy is created to provide defense for a defined amount of time, permanent insurance policy is created to offer protection for your whole life time. To keep the costs rate level, the costs at the more youthful ages goes beyond the actual price of protection. This added costs constructs a reserve (cash worth) which assists spend for the policy in later years as the price of defense surges above the premium.

Who has the best customer service for Best Level Term Life Insurance?

With level term insurance, the cost of the insurance will certainly remain the same (or possibly lower if returns are paid) over the term of your plan, typically 10 or twenty years. Unlike irreversible life insurance policy, which never ever ends as long as you pay premiums, a degree term life insurance policy plan will certainly end at some point in the future, commonly at the end of the duration of your level term.

As a result of this, many individuals use irreversible insurance as a secure financial preparation tool that can offer many demands. You may have the ability to convert some, or all, of your term insurance coverage throughout a set period, commonly the initial 10 years of your policy, without requiring to re-qualify for coverage even if your health and wellness has actually changed.

What are the top Tax Benefits Of Level Term Life Insurance providers in my area?

As it does, you may intend to include in your insurance protection in the future. When you initially get insurance policy, you may have little cost savings and a big home mortgage. Ultimately, your cost savings will expand and your home mortgage will shrink. As this takes place, you may wish to eventually reduce your death benefit or think about converting your term insurance coverage to a long-term policy.

Long as you pay your premiums, you can relax very easy understanding that your loved ones will certainly get a fatality advantage if you die during the term. Several term plans permit you the ability to transform to long-term insurance without having to take another health examination. This can enable you to capitalize on the fringe benefits of a permanent plan.

Table of Contents

- – How long does Level Term Life Insurance For Yo...

- – 20-year Level Term Life Insurance

- – Why should I have Level Term Life Insurance F...

- – Is there a budget-friendly Affordable Level T...

- – How does Level Death Benefit Term Life Insur...

- – Who has the best customer service for Best L...

- – What are the top Tax Benefits Of Level Term ...

Latest Posts

Instant Whole Life Insurance Quote

Instant Life Insurance

Best Funeral Plan Company

More

Latest Posts

Instant Whole Life Insurance Quote

Instant Life Insurance

Best Funeral Plan Company