Featured

Table of Contents

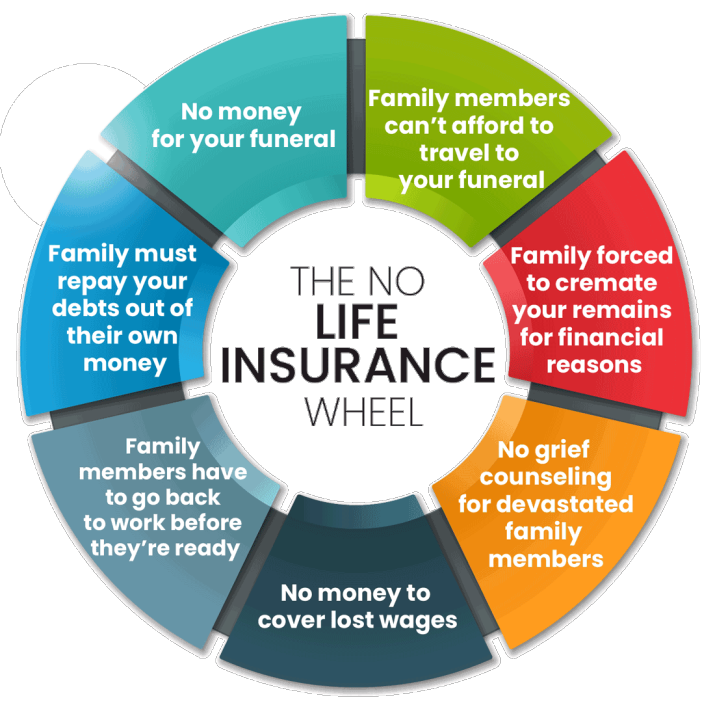

Life insurance covers the insured individual's life. If you pass away while your policy is active, your recipients can utilize the payment to cover whatever they pick medical expenses, funeral expenses, education, finances, daily prices, and also financial savings. If you have a policy, conduct regular life insurance policy reviews to see to it your beneficiaries are up to date and know how to claim life insurance policy protection if you pass.

Depending upon the problem, it might influence the policy type, price, and coverage amount an insurance firm provides you. It is very important to be honest and clear in your life insurance policy application and during your life insurance policy medical examination stopping working to divulge asked for info can be thought about life insurance fraud. Life insurance policies can be categorized into three primary teams, based on just how they work:.

What should I know before getting Riders?

OGB provides 2 fully-insured life insurance policy prepare for employees and retired people with. The state pays half of the life insurance coverage premium for covered employees and senior citizens. Both strategies of life insurance policy available, in addition to the corresponding amounts of reliant life insurance policy supplied under each strategy, are kept in mind below.

Term Life insurance policy is a pure transfer of danger in exchange for the settlement of premium. Prudential, and prior carriers, have actually been offering insurance coverage and presuming danger for the payment of costs. In the event a covered person were to pass, Prudential would honor their obligation/contract and pay the advantage.

Plan members currently enlisted who desire to include dependent life protection for a spouse can do so by offering evidence of insurability. Qualified reliant kids can be added without providing proof of insurability to the insurer. Staff member pays one hundred percent of reliant life costs. Fundamental and Standard Plus Supplemental Plans Full-Time Worker Eligible Senior citizens If retired, coverage for AD&D immediately terminates on January 1 adhering to the covered individual's 70th birthday celebration.

2018 Prudential Financial, Inc. and its relevant entities. Prudential, the Prudential logo, the Rock sign, and Bring Your Challenges are service marks of Prudential Financial, Inc. and its related entities, signed up in many territories worldwide.

What are the top Wealth Transfer Plans providers in my area?

The price structure enables workers, spouses and cohabitants to pay for their insurance policy based on their ages and elected coverage amount(s). The maximum guaranteed issuance amount available within 60 days of your hire date, without evidence of insurability is 5 times your base annual salary or $1,000,000, whichever is much less.

While every attempt has been made to guarantee the accuracy of this Recap, in case of any type of inconsistency the Recap Strategy Description and Plan Paper will certainly dominate.

You'll desire to make sure you have options available just in instance. Luckily for you, plenty of life insurance policies with living benefits can offer you with monetary aid while you're alive, when you require it the a lot of.

On the other hand, there are irreversible life insurance policy policies. These plans are commonly extra expensive and you'll likely have to go via medical exams, however the advantages that feature it become part of the reason for this. You can include living benefits to these plans, and they have money value growth potential in time, indicating you might have a couple of various choices to make use of in case you need funding while you're still to life. Mortgage protection.

How much does Life Insurance Plans cost?

These policies may permit you to include on particular living advantages while also permitting your plan to build up money value that you can take out and use when you require to. is similar to entire life insurance policy because it's a long-term life insurance policy policy that means you can be covered for the remainder of your life while taking pleasure in a plan with living advantages.

When you pay your premiums for these policies, part of the settlement is drawn away to the cash money value. This money value can grow at either a repaired or variable price as time advances depending on the type of policy you have. It's this amount that you might have the ability to gain access to in times of need while you live.

The drawback to making use of a withdrawal is that it might elevate your premium or reduced your fatality benefit. Surrendering a policy essentially implies you have actually terminated your policy outright, and it automatically gives you the money value that had actually built up, less any kind of abandonment charges and outstanding policy costs.

Making use of money worth to pay premiums is basically just what it appears like. Depending on the type of plan, you can make use of the money worth that you have accrued with your life insurance plan to pay a section or all your premiums.

What should I know before getting Cash Value Plans?

The terms and amount readily available will certainly be defined in the plan. Any kind of living benefit paid from the survivor benefit will lower the quantity payable to your beneficiary (Life insurance). This payout is indicated to aid provide you with comfort for the end of your life in addition to help with medical expenditures

Critical illness rider ensures that advantages are paid directly to you to pay for therapy solutions for the ailment defined in your plan agreement. Long-lasting care motorcyclists are implemented to cover the price of in-home care or assisted living home costs as you age. A life negotiation is the procedure through which you sell a life insurance policy policy to a 3rd event for a round figure payment.

Where can I find Mortgage Protection?

That depends. If you remain in a long-term life insurance plan, then you have the ability to withdraw cash while you live through financings, withdrawals, or giving up the plan. Before deciding to take advantage of your life insurance policy policy for cash, speak with an insurance coverage agent or representative to figure out just how it will impact your recipients after your death.

All life insurance policy plans have something in common they're created to pay cash to "called beneficiaries" when you pass away. Legacy planning. The beneficiaries can be one or more people or also an organization. Policies are bought by the individual whose life is insured. Nevertheless, life insurance coverage policies can be taken out by spouses or anybody that has the ability to verify they have an insurable rate of interest in the individual.

What should I know before getting Retirement Planning?

The policy pays cash to the called beneficiaries if the insured passes away during the term. Term life insurance policy is meant to provide lower-cost insurance coverage for a particular duration, like a 10 years or 20-year duration. Term life policies might consist of an arrangement that permits coverage to proceed (renew) at the end of the term, even if your health and wellness standing has actually altered.

Ask what the premiums will certainly be before you restore. Ask if you lose the right to renew at a particular age. If the policy is non-renewable you will require to look for coverage at the end of the term. is different due to the fact that you can keep it for as long as you need it.

Latest Posts

Instant Whole Life Insurance Quote

Instant Life Insurance

Best Funeral Plan Company